In this time and age of improved computing skills and understanding, the way in which ecommerce businesses process transactions is always under intense scrutiny. Technology has evolved to the point where payments can easily be accepted in a number of swift and simple methods. From storing payment card information to number recognition, purchasing goods online is now a simple process for consumers and merchants alike.

There is a genuine threat out there though. The number of fraud cases worldwide makes for pretty frightening reading. According to SagePay, small and medium sized enterprises were collectively subject to a nearly £18 billion loss as a result of fraud. This roughly translates to an average £3450 deficit per company. That’s a significant amount to many small businesses and in some cases could be the difference needed to stay afloat each month.

With such alarming figures for SME revenue loss, and working with feedback from customers, SagePay have taken the necessary steps to reduce fraud. In an effort to demolish online fraud and protect incomings of their customers, the company has made alterations to fraud management told incorporated with MySagePay.

Fraud Screening Upgrades

Changes to fraud rules have seen improvements in foreseeing the potential risk of each ecommerce transaction. The introduction of many new rules will hopefully deter fraudsters and attract more revenue. With this upgrade, users have the data needed to make judgemental decisions of whether or not to accept any purchase. SagePay hope that this new feature will protect companies from fraud without affecting those genuine customers who are not committing any form of cybercrime.

3D Secure users have an added level of protection. 3D Secure status improvements have been implemented which give a more accurate ranking by displaying “AttemptOnly” when the process is started but not finished. The result is integrated within risk levels to show how big a threat is presented.

There is also an ability to add extra fields for reporting and screening fraud levels. Bespoke ReD fraud screening users can make use of screening responses being sent in real time. Responses will display “Accept”, “Deny”, “Notchecked” or “Challenge” to help make more educated choices.

Decision Making Platforms

SagePay fraud prevention updates have seen the use of field specific lexis cut. Rather than being jargon heavy and perhaps a little difficult to understand, fraud rules are partnered with easy to fathom information.

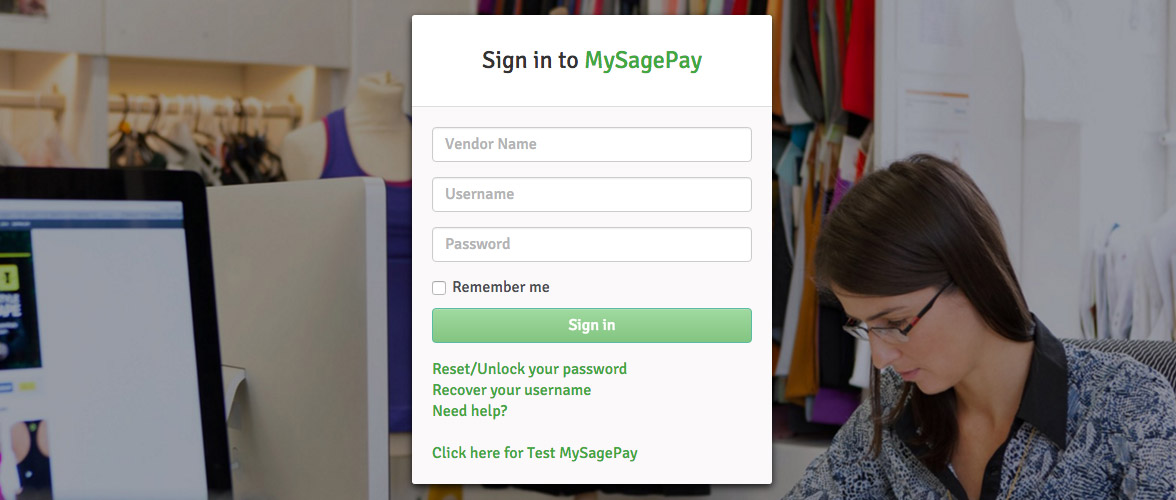

There has also been new features added to try and speed up customer support queries. All points that a vendor requires to make a transaction decision are displayed in their MySagePay section of their account.

All of these improvements will no doubt be of benefit to SagePay customers. With such high levels of internet crime being witnessed, even to large companies with a magnitude of firewalls and protective measures in place, an extra added peace of mind will surely be welcomed by ecommerce sellers.

Author Biography

Mathew

A 14 year industry veteran that specialises in wide array of online marketing areas such as PPC, SEO, front end web development, WordPress and Magento development.

Accredited Google Partner & Bing Ads qualifications, BA (Hons) in Digital Marketing. One half of the Director duo at Kumo.